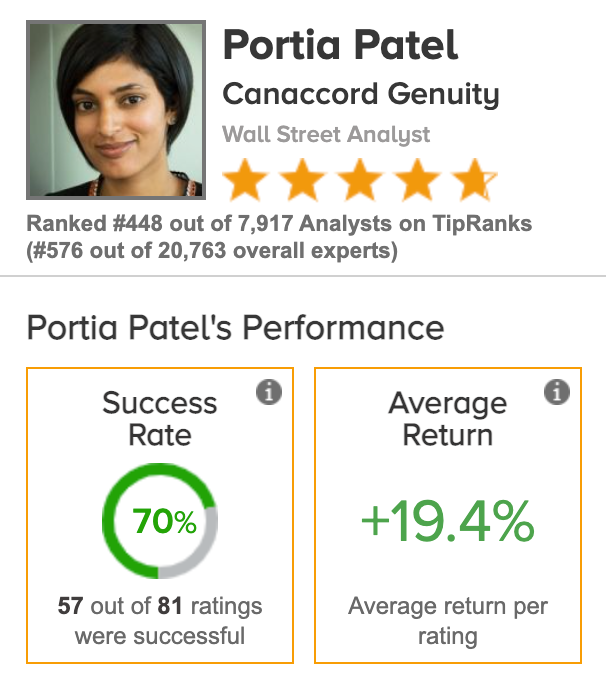

Portia Patel is a director at Canaccord Genuity – and has some very smart tips on stocks in the financial sector.

She is ranked 448 out of 7,917 analysts on TipRanks.

She has primarily covered UK small and mid-cap financial stocks since 2012 and previously worked for Liberum and RBC.

Patel is a five-star rated analyst in TipRanks rating system, with a success rate of 70%.

She has an average return of 19.4% per rating. Her buy recommendation of the stock of Charles Stanley (GB:CAY) generated a 120% return between October 2020 and October 2021. This was Patel’s best rating so far.

Patel has a high success rate on two of her rated stocks. Financial services group, Paragon Banking (GB:PAG) and corporate restructuring firm, Begbies Traynor (GB:BEG), have success rates of 80% and 94%, respectively.

Patel has a Buy rating on both these stocks.

Let’s see the two stocks in detail.

Paragon Banking Group – numbers don’t lie

Paragon Banking deals in diversified financial services such as mortgages and commercial lending.

Last month, the company posted its half-yearly results, which ended on March 2022. Despite the challenges of the current economy, the company posted underlying profits of £105 Million, up by 27.3%.

The higher volumes were majorly driven by buy-to-let mortgages, which increased by 19.5% in this period. Total completions came to £854.6 Million out of which 98% were specialist buy-to-let.

The main highlight from the results was that the buy-to-let new business pipeline at the end of the period was at £1,337.8 million, which is a record 44% higher than the last year.

This, coupled with the higher interest rates charged on loans, drove profitability for the company. Paragon’s net interest margin grew by 25 basis points.

Richard Rowntree, Paragon Bank Managing Director of Mortgages, said: “These are an excellent set of results which reflect Paragon’s focus on the specialist end of the buy-to-let market. Portfolio landlords demonstrated a strong desire to acquire additional property during the period, helping to underpin the private rented sector at a time of record tenant demand.”

The company’s capital and liquidity position are well above the regulatory requirements. This allowed Paragon to safely declare an interim dividend of 9.4p per share and increase share repurchases from £50 million to £75 million.

View from the city

According to TipRanks’ analyst rating consensus, Paragon stock is a Moderate Buy. Out of five analyst ratings, there are three Buy recommendations, and two Hold recommendations.

The average price target is 644.75p, with a high forecast of 680p and a low forecast of 600p. The price target implies upside potential of 31.4%.

Begbies Traynor Group – Winner of the pandemic

Begbies Traynor mainly provides insolvency, restructuring, and consulting services to other companies.

The company benefited from the pandemic, which resulted in a lot of insolvencies. As the slowdown in the economy continues, Begbies has a lot of work on its plate.

The high demand of the company is cleverly met by its acquisition strategy. The company has expanded its business both geographically and also services-wise via acquisitions. In the last year, Begbies acquired three recovery services companies.

Executive chairman Ric Traynor said: “We performed strongly in the financial year with results comfortably ahead of market expectations and significantly ahead of the prior year. This reflected the material increase in scale and scope of the group since 2021 following our acquisitions and investment in both divisions.”

Begbies’ stock has performed well in the last year and has grown 11.9%. The three-year growth of the stock is very impressive at 87.8%.

View from the city

According to TipRanks’ analyst rating consensus, Begbies stock is a Moderate Buy. The stock has one buy rating from Portia Patel.

The average price target is 138.0p, which is 3.63% lower than the current price level.

The stock is attractive from a dividend point of view. Begbies’ dividend yield is 2.16% higher than the industry average of 0.54%.

Conclusion

The two stocks from Patel’s list make good additions to one’s portfolio.

Paragon’s lending portfolio, along with strong rental demand and increasing rent, makes it well placed to face the short-term challenges ahead. The stock is already down 11.7% YTD, making it a good entry point.

On the other hand, Begbies is already riding high on the increased insolvencies and liquidations. The company is optimistic about its outlook as it is set to beat expectations.

Disclosure