R.M. Nunes

Against the backdrop of an increasingly hawkish Federal Reserve, banks will start reporting Q2 earnings on Thursday. The higher rates are good for net interest income, but bad for lending businesses as the increased cost of capital tamps down demand.

For an overall look, net interest income is expected to rise on higher interest rates, while fees from investment banking, mortgages, asset/wealth management and deposit service charges are expected to drop, according to Jefferies analysts led by Ken Usdin, who expects investment banking fees to bottom in Q2.

“NII strength overcomes weaker fees for 2Q, with costs little changed and credit fine (for now),” Usdin said in a note to clients. The Jefferies analysts expect 12 rate hikes (25 bps each) in 2022 “This and strong loan growth lifts NII estimates, but Q-Q NII growth starts to top-out toward YE22.”

Bank earnings should outperform Q1 levels, but lag robust year-ago results, said Credit Suisse analyst Susan Roth Katzke in a note: “What’s driving the sequential growth… the lift in interest rates is the strongest supporting positive to the fundamental picture, with healthy loan growth and low loss rates equally as welcome; weaker market-related revenue (other than trading) and mortgage banking should be well understood.”

She’s confident on bank’s fundamentals, but more cautious on the potential for upward estimate revisions. Katzke’s highest conviction recommendations are Goldman Sachs (GS), Wells Fargo (WFC), Bank of America (BAC), and JPMorgan Chase (JPM).

Downward EPS revisions: Early this month, Wells Fargo analyst Mike Mayo trimmed his EPS estimates due to the decline in capital markets activity and the expected increase in current expected credit loss (“CECL”) reserves. He favors Main Street banking over Wall Street banking, with regional banks faring well.

He sees rising rates fueling the best NII growth in four decades and solid pretax margin expansion for the sector.

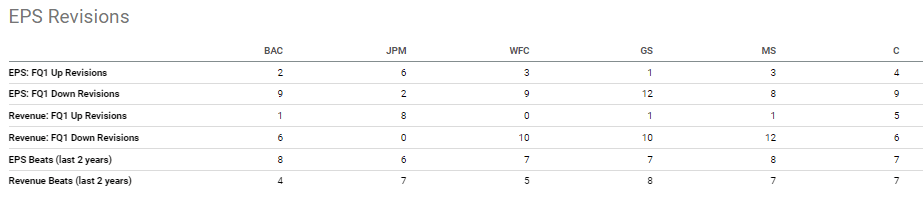

Taking a look at Q2 EPS revisions, analysts have been cutting their earnings estimates for most of the six biggest U.S.-based banks. Citigroup (C) fared the best in the past month with the Q2 EPS consensus estimate rising 0.8%, followed by JPMorgan (JPM), with a 0.3% decline in the same period.

The megabank that saw its Q2 EPS consensus estimate drop the most is Goldman Sachs (GS), down 13% in the past month. The bank’s consumer banking unit’s Q2 burn rate is reportedly in line with projections for a $1.2B loss this year.

Morgan Stanley said its analysts who cover banks and consumer finance are in line or below consensus on ~80% of the stocks in its coverage for Q2 2022. Their Q2 EPS estimate for Wells Fargo (WFC) at $0.64, is 24% lower than the consensus of $0.84, their biggest divergence from the Street. On the opposite end of the spectrum, the analysts estimate that Citizens Financial (CFG) will earn $0.97 per share in Q2, 9% more than the $0.89 consensus.

Credit risk stays low, for now: CFRA analyst Kenneth Leon doesn’t expect any of the largest banks to post Y/Y EPS growth in Q2, but expects Bank of America (BAC), Citigroup (C), and JPMorgan Chase (JPM) to show positive revenue growth. He expects Goldman Sachs (GS) and Morgan Stanley (MS) may be buying opportunities, citing their leading franchises and low valuations.

“For now, the largest banks are likely to confirm low credit risk to credit cards, commercial and industrial loans, commercial real estate, and trading/counterparty losses,” Leon said in a note to clients. But that will change if the U.S. hits a recession later this year or in 2023. Consumers are depleting personal savings as rising food, fuel, and housing costs are reducing discretionary income.

Financial earnings schedule

Thursday, July 14: JPMorgan Chase (JPM), Morgan Stanley (MS), First Republic (FRC)

Friday, July 15, BlackRock (BLK), Citigroup (C), U.S. Bancorp (USB), State Street (STT), Bank of New York Mellon (BK), Wells Fargo (WFC), PNC Financial (PNC), Charles Schwab (SCHW),

Monday, July 18: Bank of America (BAC), Goldman Sachs (GS), Synchrony Financial (SYF).

Tuesday, July 19: Truist Financial (TFC), Ally Financial (ALLY), Citizens Financial (CFG), Silvergate Capital (SI)

Wednesday, July 20: M&T Bank (MTB), Northern Trust (NTRS), Nasdaq (NDAQ), Discover Financial (DFS), Comerica (CMA)

Thursday, July 21: Blackstone (BX), Fifth Third Bancorp (FITB), Huntington Bancshares (HBAN), KeyCorp (KEY), Capital One Financial (COF), Bank OZK (OZK)

Friday, July 22: American Express (AXP), Regions Financial (RF).

SA contributor Brian Gilmartin sees banks/brokers as attractively valued this Q2 earnings season